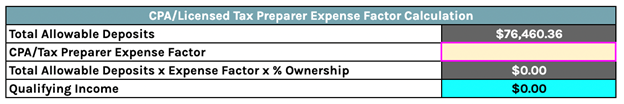

Total Allowable Deposits: All deposits from column C that are marked as “Included” in Column D

CPA/Tax Preparer Expense Factor: user entry required for the expense factor supplied by a CPA or Tax Preparer

Total Allowable Deposits x Expense Factor x % Ownership: The Borrower’s % of Ownership of Business multiplied by the difference of the Included deposits minus the total of Included Deposits multiplied by the CPA Expense Factor.

=(Included Deposits - (Included Deposits x CPA Expense Factor)) x Borrower % Ownership of Business

Qualifying Income: Qualifying Business-Related Deposits x CPA Expense Factor x % Ownership divided by the Total Months Included

Comments

0 comments

Please sign in to leave a comment.